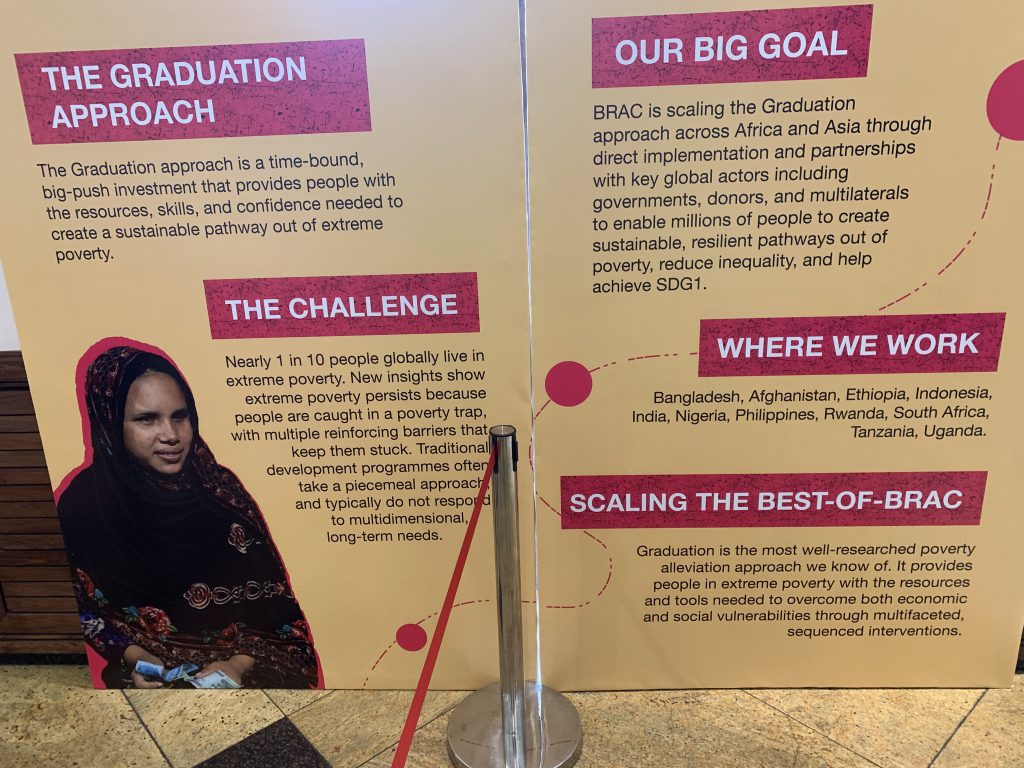

Today was the last day of One BRAC week. We learned about the Ultra Poor Graduation Initiative – a BRAC project run in conjunction with countries. It is estimated there are 700 million people living on less that $1.90 per day – the ultra poor. BRAC initially addressed this group of people living in poverty in Bangladesh. With careful review and analysis they determined their approach to helping the ultra poor to “graduate” to being less impoverished was success. This approach is multi-dimensional addressing the many aspects of an individual’s life that results in being impoverished. This program is an example of the data driven approach used by BRAC to address social and economic empowerment.

The day began with a discussion of Africa led by Lord Mark Malloch-Brown and Zainab Usman. They noted that Africa is in transition to becoming 25% of the world population by 2050 with a preponderance of young people. There are critical challenges facing Africa as it needs jobs and electric power to provide a decent life for this growing population. Both believed the current economic and governmental paradigms, not just in Africa but also in the rest of the world, are broken. New paradigms will be needed to create a more inclusive economy and one which will serve this rapidly growing young population.

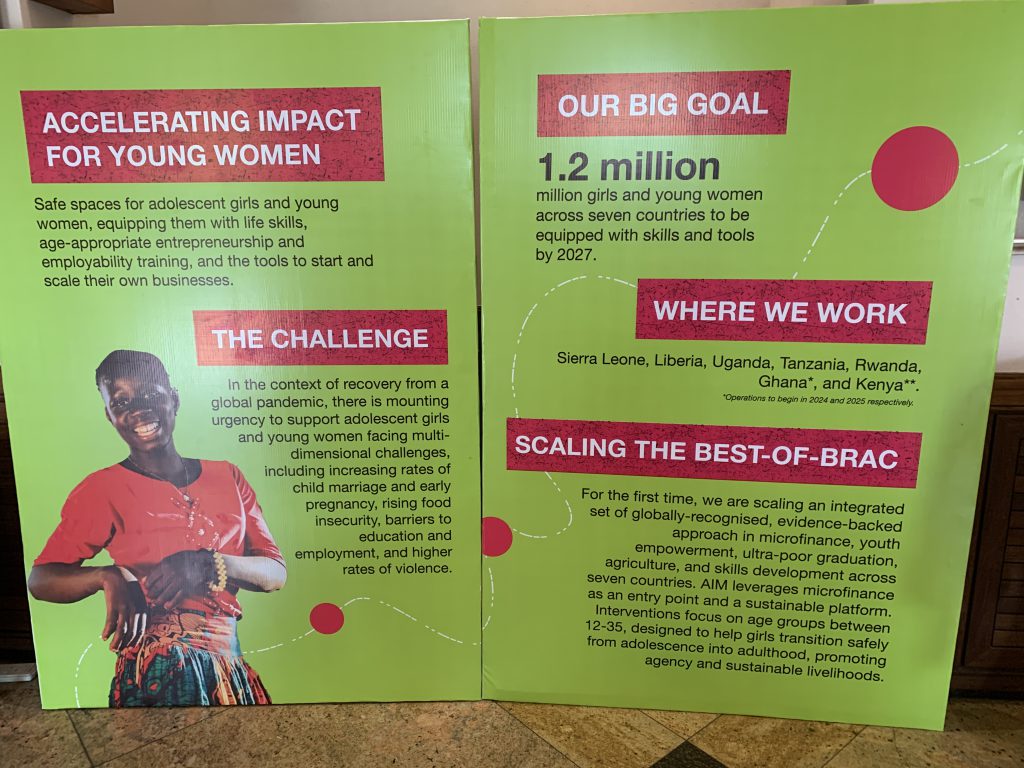

We finished the day with a short discussion of the challenges BRAC faces in its operations around the world. In Afghanistan BRAC provides schools for 30,000 young girls in a environment that makes that increasingly difficult. The work in India addressing ultra poor poverty runs into roadblocks in areas where there is a deeply engrained casted system. Empowering young women in Africa faces challenges where social norms encourage or require female genital mutilation. BRAC works to address these challenges in a way that is respectful of the communities where they operate.

One BRAC week has been an eye opener for me whilst also confirming that BRAC is unique in its approach to addressing social and economic empowerment.